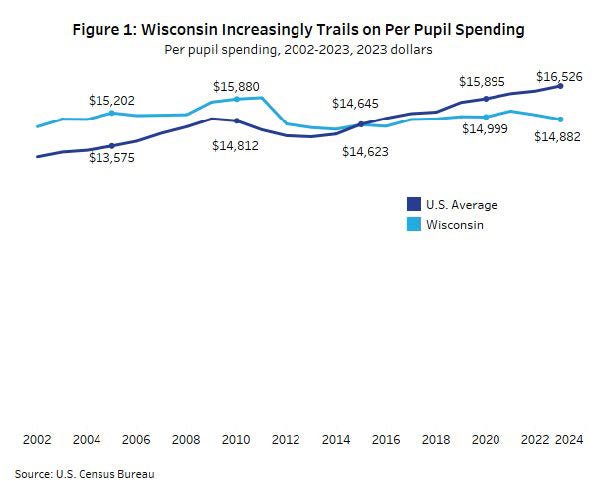

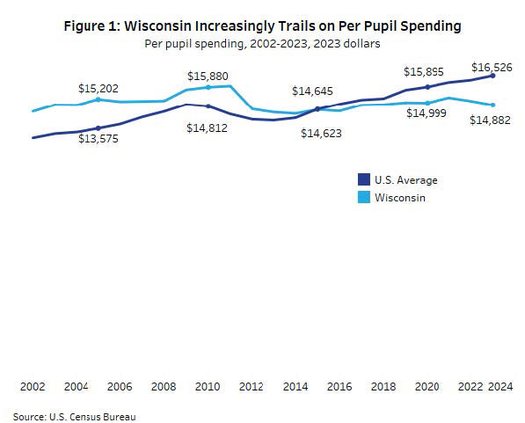

Wisconsin spent $14,882 per pupil on public elementary and secondary education in the 2023 fiscal year, the most recent year for which U.S. Census Bureau data are available. This was 9.9% less than the national average of $16,526.

When adjusting for inflation, Wisconsin preK-12 education spending per pupil has increased slightly (2.4%) since 2002 — the earliest year for which Census Bureau figures are available. In 2002, Wisconsin spent $14,522 per pupil in inflation-adjusted, or real, dollars, compared to $14,882 in 2023 (see Figure 1). The national average per pupil real spending amount increased much more during this period (21.1%), from $13,043 in 2002 to $16,526 in 2023.

Wisconsin ranked 26th among the 50 states in the per pupil amount it spent on public schools in 2023. This was down from 25th in 2020, the latest data available at the time of the Forum’s most recent analysis of this issue.

This continues a long-running decline in our state’s rank for per pupil education spending, which was 11th in 2002. Wisconsin ranked seventh among 12 Midwest states in 2023, compared to first in 2002.

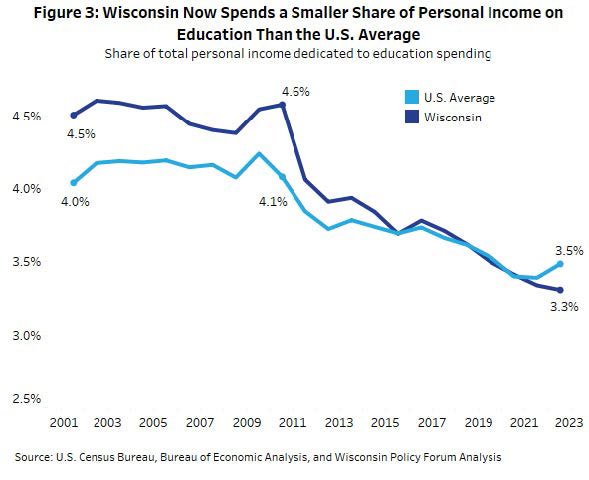

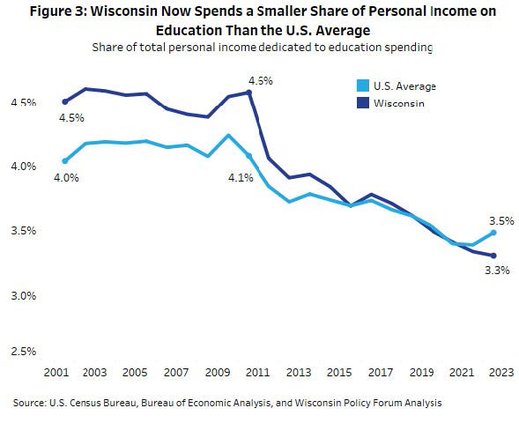

When statewide education spending is measured as a share of all residents’ combined personal incomes, Wisconsin also has been on a long-term decline. In the 2000s and early 2010s, Wisconsin spent a significantly larger share of personal income on education compared to the national average. This share declined to roughly match the nation for a period prior to the COVID-19 pandemic. In 2023, however, that share increased nationally but continued to decline in Wisconsin.

These figures are the latest examples of a decades-long shift in our state’s investment in public education and state and local tax burden relative to its peers. Observing them is particularly timely as state policymakers recently enacted the state’s next two-year budget, of which K-12 education is the largest spending priority for the state.

Federal data grounds analysis

The U.S. Census Bureau’s Annual Survey of School System Finances collects finance information by fiscal year from public school systems across the country. It includes school districts and some charter schools, but excludes those charter schools operated by private entities as well as all private schools.

Revenue sources cited in the survey include federal, state, and local government funding. The data include current spending on operations such as on employee salaries and benefits, supplies, certain contractual services, as well as for maintenance and minor building repairs. However, spending on major capital projects such as facilities construction or renovation is excluded.

Since the vast majority of funding for preK-12 education comes from state and local sources, the spending data offer a window into policy decisions at those levels about how education spending is prioritized.

To account for inflation, we use the U.S. Bureau of Labor Statistics’ Consumer Price Index to adjust past spending amounts to 2023 dollars. This was particularly valuable to analyze spending from 2020 to 2023, as inflation in this country was at or near its highest rate in decades for part of that period.

Impacts from revenue limit freeze

In our 2022 report on this topic, we noted that future years would reflect the impact of Wisconsin’s 2021-23 state budget — and that it could mean “further slow growth in school spending here relative to the rest of the country.” That budget froze state per pupil revenue limits, which restrict the amount that districts can collect from their two primary revenue sources, state general aids and local property taxes.

Our prediction was borne out in the new data from 2020 to 2023. During those years, per pupil education spending increased by a total of 4.0% nationally on an inflation-adjusted basis. In Wisconsin, it decreased 0.8%. The impact of the revenue limit freeze was particularly noticeable in 2022 and 2023. At the national level, per pupil inflation-adjusted education spending saw annual increases of 0.8% and 1.6%, respectively, during those years. In Wisconsin, it declined annually by 1.2% and 1.5%, respectively.

Wisconsin’s recent declines come in spite of the fact that the state’s school districts received more than $2 billion in federal pandemic relief aid. Not all of these dollars are contained within the current Census Bureau data, since districts could obligate or spend them through September 2024. Still, the fact that Wisconsin’s inflation-adjusted per pupil expenditures decreased in 2022 and 2023, despite the infusion of federal funds, appears to reflect the impact of the revenue limit freeze, as well as the effects of inflation. The declines also come in spite of Wisconsin voters passing record numbers of ballot referenda authorizing districts to increase education funding above revenue limits.

Because these are per pupil figures, student enrollment is the other key determinant of the amounts analyzed in this report. Even if statewide spending were constant from one year to the next, per pupil amounts would rise if enrollment fell or drop if enrollment rose. One might wonder, therefore, whether Wisconsin’s per student spending decline reflects enrollment changes as much as any spending or inflationary shifts.

In fact, Wisconsin’s preK-12 student enrollment has decreased much more than the nation’s on a percentage basis in the 21st century — though the gap between them has narrowed since 2020. From 2002 through 2023, preK-12 student enrollment declined 7.3% in Wisconsin, from 875,592 students to 811,661. That was compared to a 1.3% decline nationally during the same period.

The state’s loss of students means that Wisconsin’s current per pupil spending figures actually look better than they would if both state and national enrollment had held steady since 2002. If we instead look at total (rather than per pupil) preK-12 education spending, it declined 5.0% on an inflation-adjusted basis in Wisconsin from 2002 to 2023, when it was $12.1 billion. Total real preK-12 spending nationally increased 25.1% during this same period, reaching $769.7 billion in 2023.

Rank declines among Midwest states

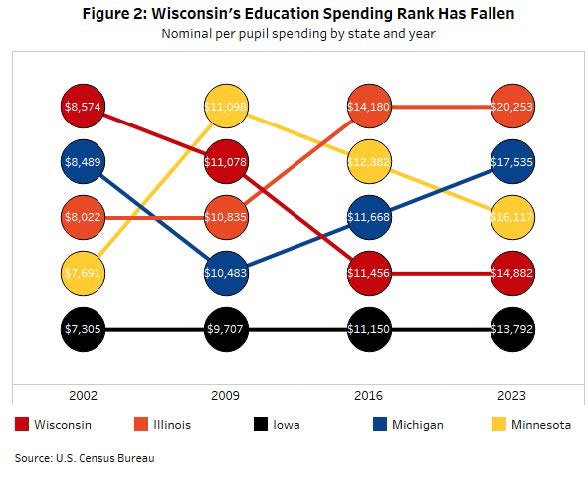

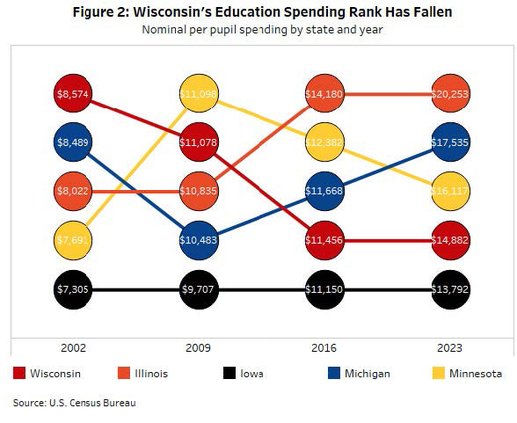

Similar patterns emerge when comparing our state’s per pupil education spending to neighboring states, as shown in Figure 2 on the previous page.

In 2002, Wisconsin ranked first among all neighboring states in per pupil education spending, at $8,574 per pupil. Over time, its rank among neighboring states declined, reaching fourth out of five by 2016.

At that point, it only narrowly lagged the third-ranked state, Michigan, and was not far behind the second-ranked state, Minnesota. By 2023, it ranked a more distant fourth, well below both of those states in per pupil spending.

Education spending down as share of income

Several reasons lie behind Wisconsin’s lagging pace of spending relative to the nation and neighboring states. First, in 2011, the state budget decreased school revenue limits for the 2011-12 school year by 5.5%. That same year, state policymakers also enacted 2011 Act 10, the landmark state law limiting collective bargaining for teachers and other school staff. As a result of the law, districts reduced their health care spending and increased employees’ contributions toward their pension and health benefits. One impact of these changes was that, in the subsequent period of the 2010s, districts began spending significantly less on benefits for their employees.

Second, policymakers prioritized lowering the state’s tax burden, or the share of residents’ income paid in state and local taxes. Our 2022 report noted that this reduction occurred over the same years as Wisconsin’s declining rank in per pupil education spending. These two trends are related, since state and local taxes are the primary source for education funding in Wisconsin and nationally and education is a top spending priority.

Our updated analysis finds that, not only has the overall state and local tax burden dropped further, but the trend of a lower share of personal income going to education has also continued, and in some respects accelerated, in the three years since.

Early in the 21st century, Wisconsin spent a larger share of its personal income on preK-12 public education than the national average. In 2002, this share was 4.5%, compared to 4.0% nationally. As shown in Figure 3, while education spending as a share of income declined sharply at a national level in the period following the Great Recession, Wisconsin declined even more markedly.

Our state tracked the nation fairly closely on this measure during the late 2010s and early 2020s before falling behind the nation. By 2023, Wisconsin spent about 3.3% of personal income on education, compared to about 3.5% nationally. It is worth noting that Wisconsin’s greater enrollment declines may have played at least some part in this trend.

Conclusion

There are many fiscal metrics by which to evaluate how our state invests in our public preK-12 education system, and each has benefits and drawbacks. Crucially, none offer direct insight into what matters most to policymakers across the partisan spectrum: the quality of educational outcomes for Wisconsin children.

Yet while the amount of spending on preK-12 is not the only factor that enables schools to provide a quality education, it plays a key role. Our analysis makes clear that Wisconsin’s national rank on education spending continues to decline. To a greater extent than other states, Wisconsin also is spending a declining share of income earned by its residents on education. Other policy interests like reducing the tax burden on state residents appear to have taken priority.

Several developments could alter this trajectory going forward. In the 2023-25 state budget, Gov. Tony Evers used his partial veto authority to increase school revenue limits by $325 per pupil starting in the 2023-24 school year, and each year going forward through 2425.

More recently, as this report was being written, state legislators and Evers struck a deal on key provisions of the 2025-27 state budget. The newly enacted budget retains the previous revenue limit increases. It also significantly increases state funding to school districts for special education, with the increase totaling about $505 million over the next two years with additional funds for high-cost special education.

In addition, 2024 was a record year for passage of school district referenda that authorize districts to increase their property tax levy to amounts above what otherwise would be allowed under state revenue limits. Together, these decisions could provide districts with additional resources that, in future years, could mean that Wisconsin regains some ground or holds steady in comparison with the U.S. average. Wisconsin’s greater enrollment declines could also help to prop up its per pupil spending in the future.

On the other hand, referendum voter approval rates have slowed, the state’s tax burden was still falling at least as of 2024, and federal pandemic relief aid has now dried up. Furthermore, as of publication, $72.6 million of federal funds for Wisconsin schools have been frozen by the U.S. Department of Education, with future federal dollars uncertain.

Finally, the newly enacted 2025-27 budget does not increase state general aids to school districts. While increasing revenue limits provides districts a pathway to bolster their funding, it will need to come through increasing local property taxes rather than additional state general aid. Some areas of the state may be willing and able to pay more property taxes to support their schools, while others may lack that willingness or may struggle financially to do so.

It should also be noted that school boards will have to decide whether to increase property taxes — the tax base for which is primarily residential property — at a time when more people are struggling to afford the cost of housing.

Public education is a primary responsibility of state and local government and these findings may be worth policymakers considering as they move forward. Tracking what our state and school districts collect and expend demonstrates the public’s investment in our education system — and what families, educators and taxpayers should expect in return.

— This information is provided to Wisconsin Newspaper Association members as a service of the Wisconsin Policy Forum, the state’s leading resource for nonpartisan state and local government research and civic education. Learn more at wispolicyforum.org.