In 2025, state funding for Wisconsin’s Municipal Services Payments (MSP) program saw its first increase in more than two decades. These payments are reimbursements for police, fire, and waste services provided to state facilities, such as college campuses or prisons, that are located within the municipality’s borders. As stipulated under state law, these funds will be distributed to more than 350 municipalities in early 2026.

Under the 2025-27 state budget, funding for the program was increased 37.7%, from $18.6 million to $25.6 million. As a result, municipalities are being reimbursed for about 44.1% of what they were eligible to receive under the program in 2025 — compared to the program’s 37.6% reimbursement rate a year ago.

A few large municipalities, starting with the city of Madison, receive the bulk of reimbursements under the program. Milwaukee in particular is receiving a larger payment but is getting it because of an unusual one-time event, as we will discuss. This statewide funding increase will result in them receiving a much larger municipal services payment this year. That, in turn, will reduce pressure on their local budgets and potentially their property taxpayers while helping them maintain service levels amid inflationary pressures.

At the same time, a sizable gap remains in the form of unreimbursed costs, or the gap between the amount of state funding appropriated for the program and the total amount that municipalities were eligible to claim. The latter amounts, also called their program entitlements, are meant to estimate the municipality’s share of the cost to provide these services to state facilities during the prior year.

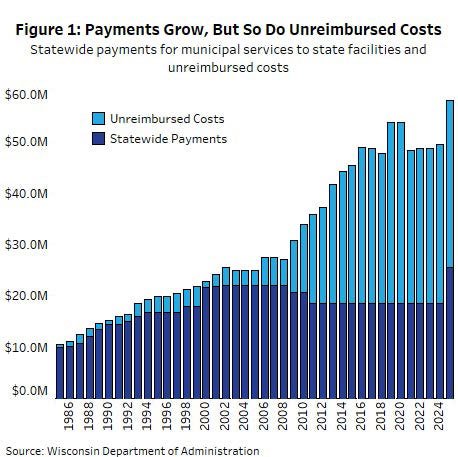

Under the 2025 program (which again involves payments made in 2026), statewide unreimbursed costs were about $32.4 million, an increase from $30.8 million a year earlier. Figure 1 shows the amounts appropriated each year for the MSP program relative to the total amount of entitlements for all participating municipalities. The chart shows this dynamic in which state funding to pay for the service costs rose but the overall expenses increased by even more.

This is due to the largest percentage increase in four decades in the total amount that municipalities were eligible to claim under the program. This, in turn, occurred in part because of a record increase in the value of state facilities — a key component of the formula used to calculate the municipal entitlements.

State policymakers provided the largest funding increase on record in 2025 for a program that reimburses municipalities to provide services to state facilities such as colleges, universities, or prisons. Notably, this increased the reimbursement rate for service costs incurred by municipalities. However, the gap still increased between municipalities’ estimated cost to provide these services and the reimbursements paid to them.

This year’s funding infusion for the Municipal Services Payments program came after its funding held roughly steady for a period beginning in 2000, decreased in 2009 and 2011, and then was frozen for more than a decade. If total funding for the program had matched inflation since 2000, it would be about $40.1 million today.

Madison, other cities receive funds

The Wisconsin Department of Administration administers the MSP program and uses a formula to calculate the amount of reimbursement earned by each municipality. Due to its many state facilities including the state Capitol and flagship University of Wisconsin campus, the city of Madison is the municipality receiving by far the most funding from the program: more than $10.1 million, or about 40% of the total. As our brief on the city of Madison’s 2026 budget noted, this was a $2.4 million increase from the year prior — a result of the large increase in state appropriations for the program in the current state budget.

Madison’s situation is unique, but for other communities — especially those with university campuses, state prisons, or state office buildings — the program also is a consequential component of their budgets. Twenty-three municipalities will receive more than $100,000 from the program, and in total, 357 municipalities are receiving an MSP payment of some amount.

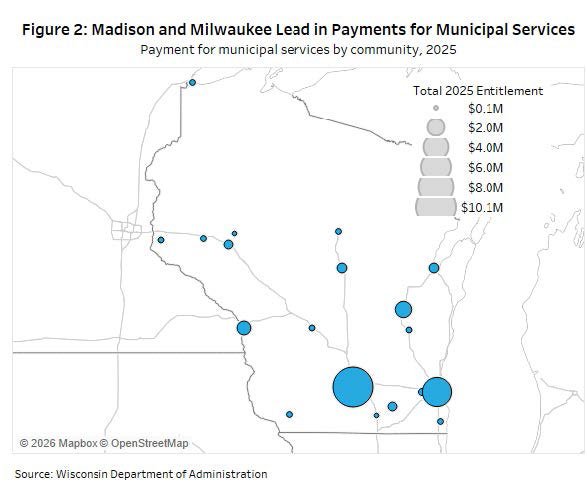

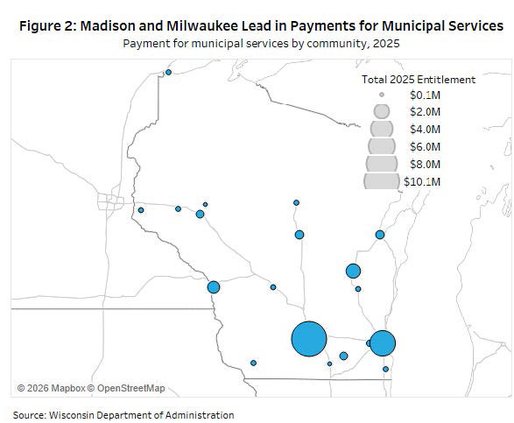

Figure 2 shows others in the top 10 for funding received from the program. After Madison, they are, in order of the amount received: the cities of Milwaukee, Oshkosh, La Crosse, Stevens Point, Green Bay, Whitewater, Eau Claire, Waukesha, and Menomonie.

Milwaukee consistently has been the second-largest recipient of payments from the program. That said, its MSP payment is much larger than usual this year, at $5.4 million. This is a 148% increase from 2019, the year analyzed in our previous report on this program — compared to the 37.7% increase in all payments statewide during this period.

While the construction of new state facilities within the city is a factor in Milwaukee’s increase, it’s also due in part to the reporting of previously constructed state facilities that were improperly left out and newly included in the payment calculations for the program this year.

Estimating service costs

The Department of Administration administers the municipal services payments program and uses a formula to calculate the amount of reimbursement to which each municipality is entitled. The payments offset the share of the local cost of providing fire, police, and waste removal services to state facilities that otherwise would be borne by the municipality’s property tax levy.

Other municipal services to state facilities, such as water, sewer, or electrical, are paid for separately by the responsible state agency in the form of user fees. While counties may not receive direct payments under the program for services such as law enforcement, they may be repaid indirectly through an inter-governmental agreement with the municipality where the state facility is located.

For more than four decades, the amount appropriated for the program by state policymakers has been less than the total amount of reimbursement for which municipalities were eligible. Accordingly, the state has prorated the available funds.

The increase in the program’s appropriation in the current budget was the first since 2003. Gov. Tony Evers’ 2025-27 budget proposed a much larger $17 million annual increase in the program’s appropriation, which would have increased the program’s reimbursement rate to about 72%.

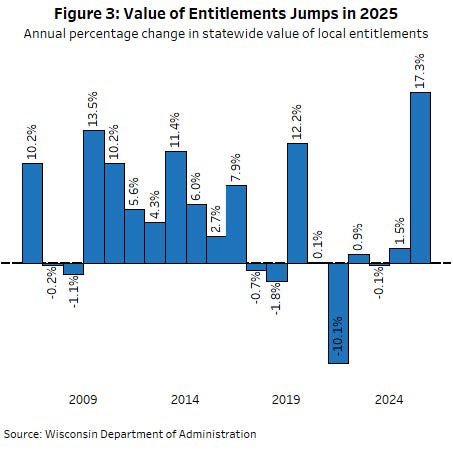

Overall, total program entitlements rose 17.3% in 2025, from $49.4 million to just under $58 million — the largest annual percentage increase since 1985. All three entitlement streams — police, fire, and solid waste — contributed to the increase, though police and fire entitlements rose much more sharply.

Over the last decade, the biggest driver of increasing entitlements, or qualifying expenses, has been the growth in those provided for fire services. They have increased by about $8.3 million statewide, or 38.0%, during the last decade. Police entitlements rose $4.6 million, or 19.6%, while solid waste entitlements declined by about $247,373, or 76.4%.

A onetime funding boost for Milwaukee

A key component of the formula used to calculate program entitlements is the ratio of the property values of all state facilities within a given municipality, relative to the combined value of all buildings and other improvements within that municipality. If this ratio increases for a given municipality, holding all other components of the formula constant, then the municipality’s MSP entitlement amount would increase.

As shown in Figure 3, the total value of all state facilities in the program saw its largest annual percentage increase on record in 2025, rising 15.9% from $19.1 billion to $22.1 lion. Part of the increase in the value of state facilities was due to newly constructed state buildings in municipalities that receive funds under the program.

A key contributor to this increase was the addition of 26 state facilities to the program inventory that were not newly constructed, but nevertheless had not, until recently, been included in DOA’s formula calculations for MSP entitlements. Some of these facilities were built decades ago, yet had not been included in MSP calculations since their construction.

Eight of these facilities were located on the UW-Milwaukee campus. Collectively they were valued at nearly $294 million, so their addition is particularly consequential for the city of Milwaukee’s MSP payment for this year.

Furthermore, on a onetime basis for 2025 only, DOA officials agreed to account for the value of the eight facilities for the previous two years as well for the purposes of Milwaukee’s payment calculation under the program to reflect the previous omission of this value. This was provided as a back payment for prior years when these facilities’ values were omitted from MSP entitlement calculations. Due to the importance of property valuation in the program’s entitlement formula, this caused a large increase in Milwaukee’s entitlement amount for 2025 and in its prorated payment.

It is not fully clear what impact, if any, the omission of state facilities from program payment calculations may have had on this year’s entitlement and payment amounts for other participating municipalities. In the future, municipalities receiving program payments may wish to verify that the state facilities they serve are being included in their payment calculation.

Conclusion

The municipal services payments program plays a vital role in reimbursing municipalities for the costs they incur to serve state facilities within their borders. For years, declining or frozen state appropriations for the program meant that it was reimbursing a steadily dwindling share of municipal service costs.

The program’s $25.6 million total appropriation pales in comparison to municipal property tax levies, which amounted to more than $3.6 billion on December 2024 tax bills. Still, for a handful of large municipalities, it is a significant source of state support.

A sizable increase in state funding for the program in the 2025-27 state budget means that municipalities are receiving considerably larger reimbursements this year to serve state facilities, and the reimbursement rate has risen. But at the same time, the gap widened between the total amount paid out to municipalities and their estimated costs to provide these services.

Without additional increases in state appropriations for the MSP program, this gap is likely to widen further in future years, and the reimbursement rate may also fall. Entitlements are likely to continue increasing as municipalities contend with inflation, rising service costs, worker recruitment and retention expenses, and other cost pressures.

One step that might help align state reimbursements and local costs would be to close or reduce the size of state facilities that are no longer needed. This could be due to a shrinking workforce, virtual work, falling enrollments on some college campuses, or other factors. Transitioning these properties to private ownership would allow local taxpayers to cover the costs of services to these parcels. State leaders already are attempting this to some degree, including through the downsizing of the state’s office real estate footprint in Madison.

As the above factors affect municipalities’ finances on the expenditure side, they also must contend with revenue constraints. In the previous state budget, state shared revenue aid increases provided a boost but were unevenly distributed. For some municipalities, it was not enough to offset the inflation surge of the early 2020s.

State-imposed levy limits continue to cap municipal property tax levies at rates of growth that are, in typical years, sub-inflationary. Municipal leaders possess few other mechanisms to increase revenue, as the Forum has documented. Meanwhile, record numbers of Wisconsin municipalities are turning to local election referenda to ask voters to increase their tax levy to fund municipal services such as public safety.

Some of these measures have succeeded with voters, though recent election results suggest they tend to be roughly a 50-50 proposition. And at a time when local property taxes throughout Wisconsin are seeing some of their largest increases in decades, primarily due to school district levy increases, these referenda may prove to be an increasingly tough sell to an electorate beset by both higher property taxes and inflation.

Together, these realities put municipalities in a challenging position. Meanwhile, state policymakers will confront a tighter state budget in the next cycle — though the most recent state revenue projections suggest the state’s position may be better than previously anticipated.

The MSP program is a key state mechanism to support municipal services to some of state government’s largest agencies and facilities. In 2027 and beyond, state leaders will have to decide what role it will play in ensuring these communities can maintain those services, without limiting their ability to serve their residents.

— This information is provided to Wisconsin Newspaper Association members as a service of the Wisconsin Policy Forum, the state’s leading resource for nonpartisan state and local government research and civic education. Learn more at wispolicyforum.org.